The financial services sector is evolving rapidly, driven by technological advancements and shifting customer expectations. In this dynamic landscape, customer engagement is paramount.

Microsoft Dynamics 365 Contact Center offers a comprehensive solution tailored to the unique needs of financial services organisations. This article explores how Dynamics 365 Contact Center enhances customer experience, improves operational efficiency, and ensures regulatory compliance, supported by use cases, examples, and compelling statistics.

Financial services organisations, including banks, wealth management firms, and insurance companies, face a multitude of challenges in today’s market. Customers demand personalised, timely, and secure interactions, while organisations must navigate complex regulatory environments and maintain operational efficiency. Dynamics 365 Contact Center addresses these challenges by providing a unified platform that integrates communication channels, customer data, and advanced analytics.

Key benefits for Financial Services organisations

Enhanced customer experience

Omnichannel Engagement

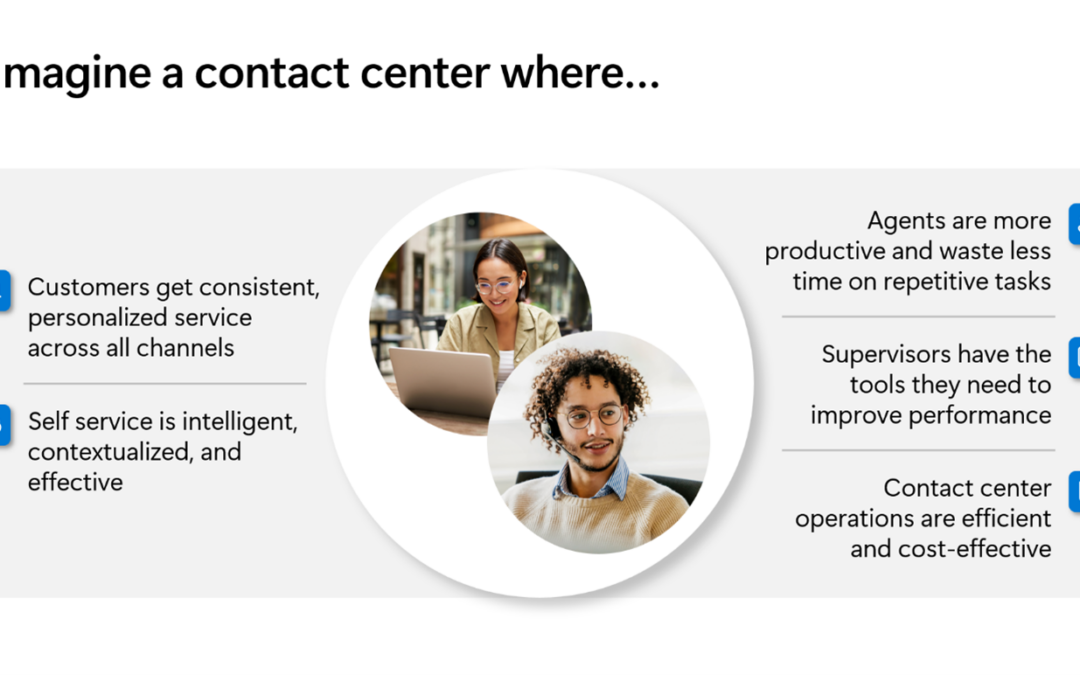

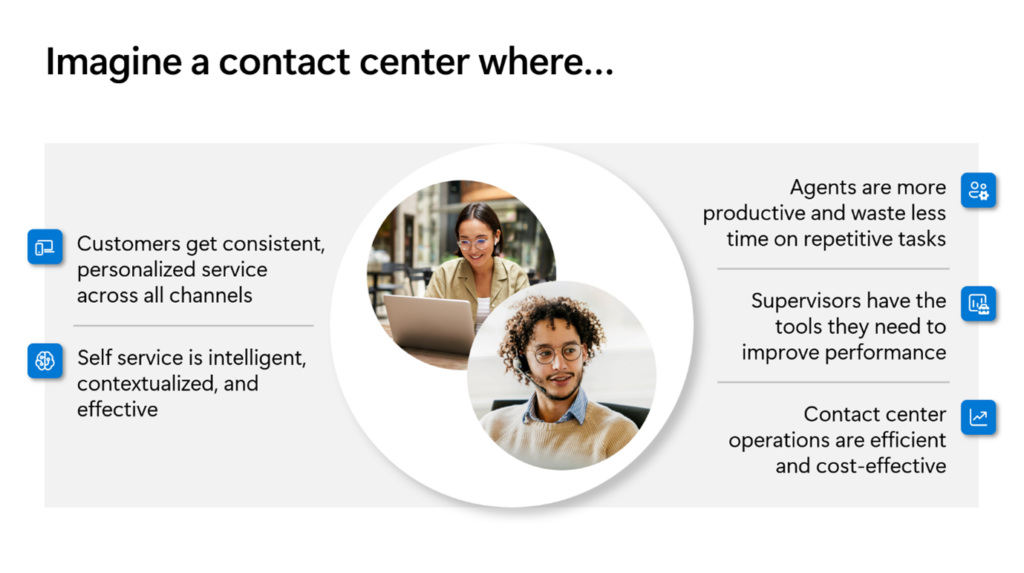

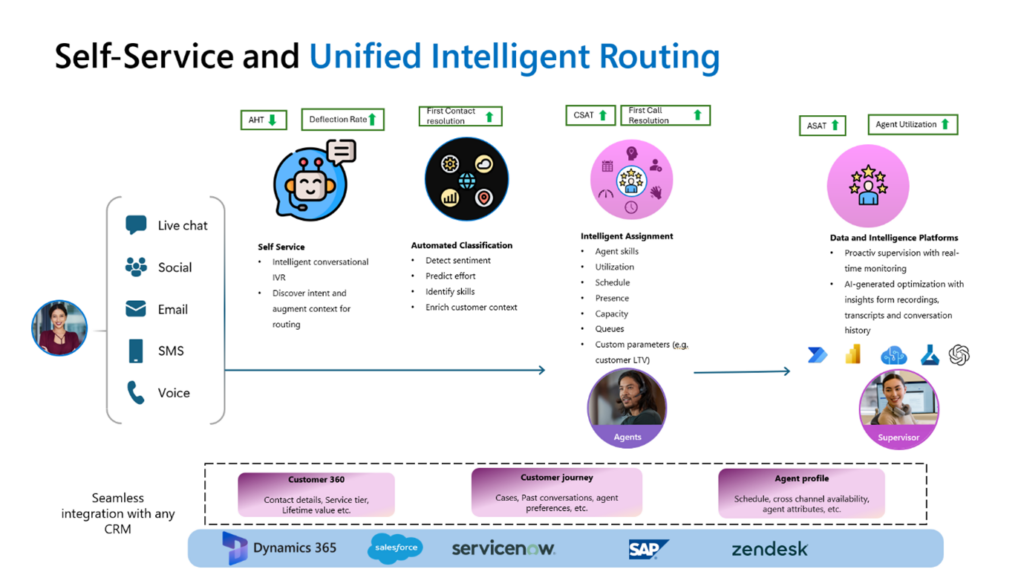

Financial institutions can no longer rely on traditional communication methods alone. Customers expect to interact through their preferred channels, whether it’s phone, email, chat, or social media. Dynamics 365 Contact Center enables omnichannel engagement, ensuring a seamless and consistent experience across all touchpoints. This capability is crucial in meeting customer expectations and enhancing satisfaction.

A retail bank implemented Dynamics 365 Contact Center to manage customer inquiries across various channels. The bank integrated phone, email, and chat support, allowing customers to choose their preferred method of communication. The result was a 20% reduction in average call handling time and a 15% increase in customer satisfaction scores. Customers appreciated the flexibility and responsiveness of the bank’s service.

Personalised Service

Personalisation is a key differentiator in customer service. By leveraging AI and customer data, Dynamics 365 Contact Center enables agents to provide tailored advice and solutions. This personalised approach not only improves customer satisfaction but also builds trust and loyalty.

A wealth management firm used Dynamics 365 Contact Center to provide personalised investment advice. By integrating customer financial data and market insights, advisors could offer more relevant recommendations. This approach led to a 25% increase in portfolio performance and a 30% rise in client retention rates. Clients valued the customised advice, which aligned with their financial goals and risk tolerance.

Improved operational efficiency

Intelligent Routing

Efficiently managing customer inquiries is critical for financial services organisations. Dynamics 365 Contact Center utilises AI to intelligently route inquiries to the most appropriate agent based on their expertise and availability. This reduces wait times, ensures customers speak with knowledgeable agents, and improves resolution rates.

An insurance company adopted Dynamics 365 Contact Center to streamline claim processing and customer support. Intelligent routing significantly reduced the time customers spent waiting to speak with an agent. The company reported a 40% reduction in claim processing time, leading to higher customer satisfaction and faster issue resolution.

Automated Workflows

Automation plays a crucial role in enhancing operational efficiency. Dynamics 365 Contact Center automates routine tasks such as data entry, document processing, and appointment scheduling. This allows staff to focus on more complex customer needs and strategic initiatives.

The retail bank mentioned earlier also implemented automated workflows to handle routine inquiries and transactions. Tasks such as balance inquiries, fund transfers, and appointment bookings were automated, freeing up agents to address more complex customer issues. This resulted in a 30% increase in agent productivity and a significant reduction in service costs.

Regulatory Compliance and Security

Data protection

Financial services organisations must adhere to stringent regulatory requirements to protect customer data. Dynamics 365 Contact Center incorporates robust security features to ensure compliance with regulations such as GDPR and industry-specific standards. Secure data handling and encryption protect sensitive customer information from unauthorised access and breaches.

A wealth management firm leveraged Dynamics 365 Contact Center’s security features to ensure compliance with data protection regulations. The platform’s secure data handling capabilities allowed the firm to store and process customer information with confidence. This not only ensured regulatory compliance but also built trust with clients, who valued the firm’s commitment to data security.

Audit trails

Transparency and accountability are essential in financial services. Dynamics 365 Contact Center provides comprehensive logging and monitoring capabilities, creating detailed audit trails of customer interactions and transactions. These audit trails are invaluable for financial audits, compliance reviews, and dispute resolution.

The insurance company implemented audit trails to track and monitor customer interactions and claim processing activities. This capability provided a clear record of each interaction, ensuring transparency and accountability. During compliance reviews and audits, the company could easily demonstrate adherence to regulatory requirements, reducing the risk of fines and penalties.

Use cases and examples

Retail banking

Retail banks often face high volumes of customer inquiries and transactions. Dynamics 365 Contact Center enables banks to manage these interactions efficiently while providing personalised service.

A retail bank integrated Dynamics 365 Contact Center to handle customer inquiries across multiple channels. By using AI-driven insights, agents could anticipate customer needs, reducing the average call handling time by 20%. Additionally, the bank reported a 15% increase in customer satisfaction scores due to the personalised service offered.

According to Microsoft, organisations using Dynamics 365 have seen a 30% reduction in service costs and a 40% increase in agent productivity. These improvements translate to better customer service and significant operational efficiencies.

Wealth management

Wealth management firms require advanced tools to provide personalised investment advice and manage client relationships effectively. Dynamics 365 Contact Center offers the capabilities needed to meet these demands.

A wealth management firm used Dynamics 365 Contact Center to provide clients with personalised investment advice. By integrating customer data and market insights, advisors could offer more relevant recommendations. This led to a 25% increase in portfolio performance and a 30% rise in client retention rates.

Financial services firms leveraging Dynamics 365 reported a 20% improvement in customer insights accuracy, enhancing the quality of service provided. This level of personalisation helps build strong client relationships and drives better financial outcomes.

Insurance

Insurance companies deal with complex customer inquiries and claims processing. Dynamics 365 Contact Center streamlines these processes, improving efficiency and customer satisfaction.

An insurance company adopted Dynamics 365 Contact Center to streamline claim processing and customer support. Intelligent routing and automated workflows reduced claim processing time by 40%, while customer satisfaction improved by 18%.

Research shows that insurance companies utilising Dynamics 365 have achieved a 50% faster resolution time for customer inquiries and a 35% reduction in operational costs. These efficiencies enhance customer experience and improve overall business performance.

Conclusion

Dynamics 365 Contact Center is a transformative solution for financial services organisations, offering the tools needed to deliver exceptional customer experiences, improve operational efficiency, and ensure regulatory compliance. By integrating advanced technologies like AI and automation, financial institutions can exceed customer expectations and achieve sustained growth in a competitive market.

The adoption of Dynamics 365 Contact Center is a strategic investment that promises significant returns. As evidenced by real-world examples and compelling statistics, this platform empowers financial services organisations to navigate the complexities of modern customer engagement and operational management effectively.

This article aims to provide a comprehensive overview of the benefits and applications of Dynamics 365 Contact Center for financial services organisations. By leveraging this powerful platform, financial institutions can enhance customer engagement, streamline operations, and maintain compliance in a rapidly evolving industry.

Why choose Microsoft for your contact centre?

Symity, part of the Charterhouse Group, is here to help you or your organisation on your journey to improve customer experience with modern Microsoft Teams certified Contact Centre solutions.

More details in Chris’s article with UC Today on this topic.

Get in touch with our Team today to find out how Symity can help you with this.

More in our CCaaS Hub.

Explore related articles: